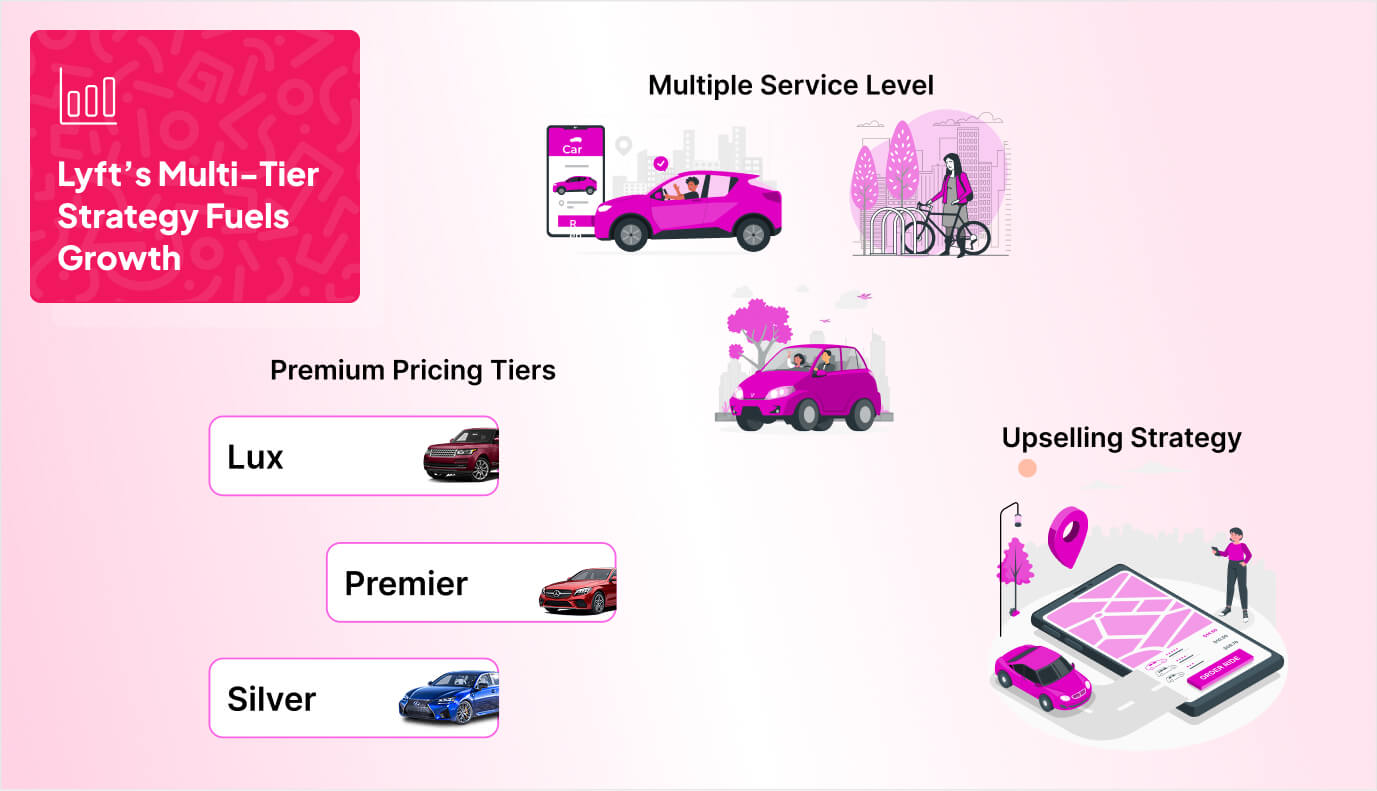

You’ll notice Lyft doesn’t stick to one-size-fits-all service and Lyft’s income strategy doesn’t stop at standard rides. By offering multiple service tiers, the company tailors experiences for different budgets and preferences while capturing higher revenue from riders who upgrade.

This strategy branches into two powerful drivers of growth: broadening service levels and maximizing premium profitability.

Let’s discuss each.

Multiple Service Level Strategy

Lyft’s success expands beyond point-to-point rides. Instead, the company has expanded into a multi-service ecosystem that captures value across a range of mobility needs. This strategy ensures Lyft earns not just from riders heading across town but also from those renting cars, biking to work, or even arranging safe travel for kids.

By meeting customers at different moments of their journey, Lyft strengthens loyalty while layering in new revenue streams. Here’s a breakdown of the services driving that diversification:

| Service Level | Description | Revenue Impact for Lyft |

|---|

| Lyft Rentals | Book rental cars directly in-app | Creates high-value transactions and keeps users in-platform. |

| Micromobility | Shared bikes and scooters available in select cities | Low-cost entry option that attracts younger, urban riders. |

| Lyft Transit | View and book public transit options alongside rides | Builds all-in-one mobility hub, expanding daily usage. |

| Kid Transport | Rides tailored for children with extra safety checks | Unlocks the family-focused market segment with premium pricing. |

| Premium Tiers | Lux, Premier, XL, and Silver options for riders who upgrade | Higher per-mile margins and loyalty from frequent riders. |

This layered service menu allows Lyft to adapt quickly to rider preferences, economic conditions, and city regulations. By capturing revenue across multiple travel scenarios, Lyft stays competitive in a rapidly evolving mobility market.

For entrepreneurs building apps, this highlights a crucial lesson: diversification reduces risk and maximizes lifetime value per user. At AppMakers USA, we help founders design platforms that replicate this kind of multi-tier strategy.

Premium Tier Profitability

Premium options are a profit engine that has helped Lyft boost its margins and achieve its first profitable year. With tiers like Lux, Premier, and Silver, the company nudges riders into higher-spend categories that deliver far more revenue per trip than standard fares.

In 2024, Lyft reported an average revenue per active rider of $55.85, a figure driven largely by premium upselling. By early 2025, bookings for premium rides reached record levels, with the newly launched Lyft Silver accounting for nearly one in five new-user activations.

What makes this strategy powerful is its compounding effect:

- Rising premium-tier bookings = higher revenue growth.

- Dual-app drivers increasingly favor Lyft, encouraging more premium adoption.

- Tiered pricing improves contribution margins, helping the company sustain profitability.

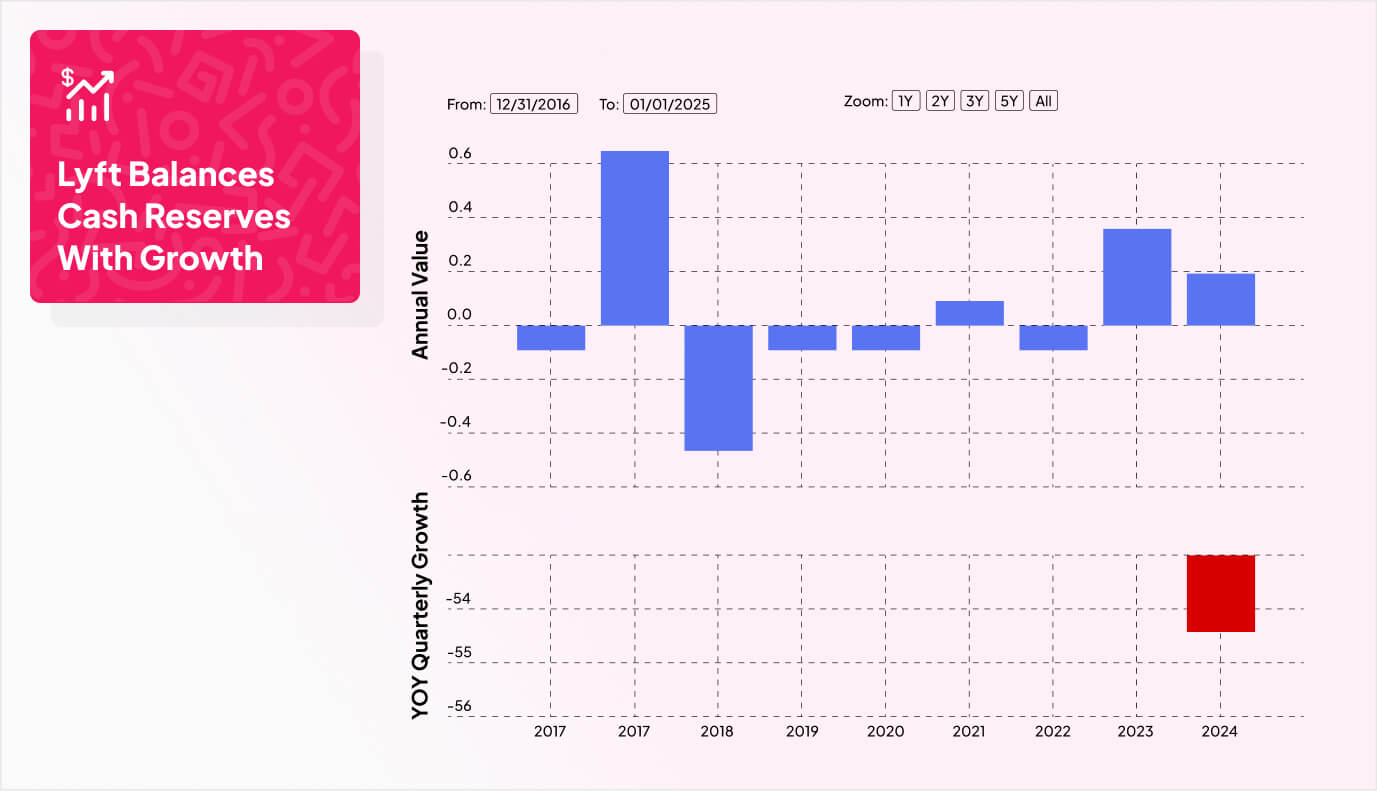

Together, these factors fueled Lyft’s $5.7 billion in annual revenue and positioned the company for reinvestment into new services and markets.

For founders, the takeaway is clear: tiered pricing can serve as both a growth lever and a loyalty tool. At AppMakers USA, we help businesses design upselling models that scale margins without sacrificing customer satisfaction.

Upselling Impact Metrics

When Lyft introduced tiered service options—a menu ranging from everyday rides to sleek premium tiers—the company opened entirely new revenue streams. You see this in how they weave upselling into every part of the user journey. By encouraging riders to upgrade or bundle services, the company turns small spending choices into major revenue gains.

When Lyft introduced tiered service options—a menu ranging from everyday rides to sleek premium tiers—the company opened entirely new revenue streams. You see this in how they weave upselling into every part of the user journey. By encouraging riders to upgrade or bundle services, the company turns small spending choices into major revenue gains.

Here’s how those metrics play out:

- Premium tiers drive revenue per rider: With XL, Lux, and Silver options, average revenue per active rider climbed to $55.85 in 2024.

- Upselling builds loyalty: Riders who experiment with premium services tend to return, boosting weekly ride volumes and retention.

- Bundled mobility services add value: Rentals, subscriptions, and micromobility (scooters, bikes) increase stickiness and broaden spending.

- Market share strength: Lyft holds 24% of the U.S. rideshare market, with upselling strategies helping it compete against Uber’s larger share.

These tactics helped Lyft generate $5.78 billion in revenue, serving 23.7 million users across North America. By turning upselling into a growth strategy, Lyft not only boosts profitability but also strengthens its brand appeal across different rider segments.