Home

Services

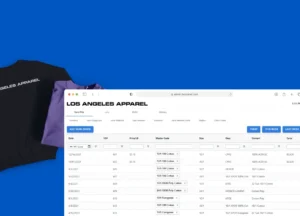

Custom Software Development

Elevate your business with our bespoke software development services.

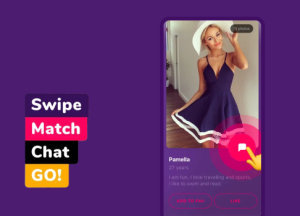

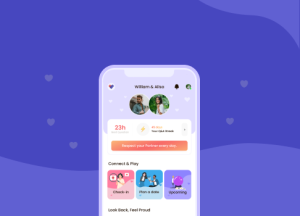

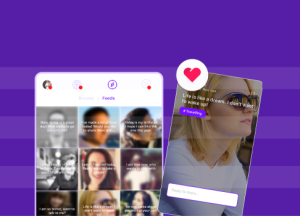

Mobile App Development

Elevate your business with our expert Mobile App Development Services.

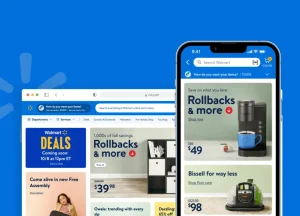

Web App Development

Explore our comprehensive web development services designed to elevate your online presence.

Artificial Intelligence

From intelligent automation to machine learning, we tailor AI solutions to meet your app's unique needs.

Low-Code/No-Code

Empower your organization with cutting-edge apps without the complexities of traditional coding.

iOS Development

Explore cutting-edge iOS app development with AppMakersLA.

Android Development

Our team merges expertise and innovation to create bespoke solutions that redefine user experiences.

Staff Augmentation

Unlock the full potential of your projects by integrating our Staff Augmentation services.

Our Process

Portfolio

FAQ

Where can I see your previous work?

Check out our portfolio at AppMakersLA.com/portfolio

What services do you offer?

We are a Los Angeles app and web development company. As such, we offer: 1) Design for Apps, Webapps and Websites 2) Mobile App Development for iPhone Apps, Android Apps and iPad Apps & Web Development for Webapps. Each project includes full QA Services as well as a product manager.

Where are your app developers located?

Our app developers are mainly located at 1250 S Los Angeles St, Los Angeles, CA 90015, though we have other offices around the world, and we hire the best developers wherever and whenever we find them. If having engineers & designers in Los Angeles is critical to the project, we have the resources to make that happen.

How much do you charge for your services?

Our cost varies depending on the project. Please contact us for a mobile app development consulting session and we will get you an estimate + analysis pronto.

Can you build software for startups?

Yes, we consider ourselves a startup app development company, as well as an agency that builds software for already established firms.

Discover 30+ more FAQs

View all FAQs